Carrier – UnitedHealthcare

Agents - Are you looking to get a quote for a group?

With some of the most comprehensive product offerings in the midwest and competitive pricing in the 2-50 market, UHC is a leading provider of employee benefits. Ask us about UHC’s latest technology, tools and resources, and value-added services.

Interested in other Carrier Product Update Videos? See all videos here.

Jason Powers:

It is time for another carrier product update. Tune in as we talk directly to the carriers about their new plans, any new network options they have, or which plan designs offer the most savings and learn about the tools and resources they offer to help you generate more business. Visit our website to learn about all of the carriers we quote in our carrier product update series.

Hello and welcome back to our carrier product update series. This is a very special edition. This is our Q four [00:00:30] kickoff summit for Q 4 20 23, but leading into January renewals for 2024. My name is Jason Powers with Legacy Brokers and I’m joined by Market Vice President of UnitedHealthcare, Mike Marillo. Thank you. Welcome back to the show, man. Thanks for

Michael Margherio:

Having me. Good to be

Jason Powers:

Here. Last time you’re on, I was super excited because you had a lot of new stuff and I thought there’s no way that you could come back a year later and top it off, but I’m excited to say I’ve kind of done a preview of the slides. [00:01:00] I know what we’re going to talk about and I’m excited once again for brokers to hear the good news that is UnitedHealthcare.

Michael Margherio:

Yeah, some cool new stuff, some updates to some stuff that has been successful for us. So yeah, we’re excited.

Jason Powers:

Well, and there may be some agents out there who have never sold UnitedHealthcare, maybe they’ve got a carrier that they’ve really gravitated toward and never really had an opportunity to put UnitedHealthcare in front of a prospect. But if you’re talking to an agent who’s never seen UnitedHealthcare’s products, how would you describe your position in the market?

Michael Margherio:

[00:01:30] Yeah, so we’re the largest national carrier. We have the largest national single network, which underpins all of our products, so adds some consistency for the member experience. The thing that we do really well I think is product suites in the local market that are designed by the local market. So what we do in Kansas City is going to be a little bit different than what we do in Chicago or St. Louis. They’ll broadly be similar names, but we’re really trying to compete in the local market.

Jason Powers:

[00:02:00] That’s great. Well, let’s not delay any further. We’ll jump right into, you’ve got an agenda for the day of the things we’re going to talk about and then we’ll get onto the updates. Yeah,

Michael Margherio:

Cool. So I think that top one actually is pretty easy to just say everything else falls under it. Everything we do is designed to impact the total cost of care, whether it’s medical, whether it’s pharmacy, network configurations, navigation tools, transparency tools, all of it’s designed to help [00:02:30] employers help their employees get to the right care at the right time and manage the cost of that.

Jason Powers:

That’s great. Jump right into some of the things that drive that total cost of care.

Michael Margherio:

Yeah, this advocate for me, this is something we did two or three years ago. This is our standard member service model. We flipped it to an advocacy model, so when people call the 800 number, they might just be calling for an ID card or they’ve a claim denied or [00:03:00] whatever. They’re going to reach an advocate and that person is there to help guide them and help them navigate through the system, whether that’s getting them that ID card or helping reprocess that claim. It might be something more complex like, Hey, we noticed that you’re filling, you’re not, you’ve filled some drugs for diabetes and now you’ve stopped. Can we help you close that gap? So really tried to make it so that when people reach us, they’re engaged in their healthcare and we can be the most helpful for them at that time,

Jason Powers:

[00:03:30] Again, going back to member experience, less of a customer service traditional model and more that advocacy for the member.

Michael Margherio:

And we did simple things like we stopped measuring how quickly we can get our reps off the phone and started measuring how well they do in resolving people’s issues. So really flipping the script to try to help people. We recognized that when they call us, they’re engaged in it and we have a better interaction with them as a

Jason Powers:

Result. That’s great. Good news [00:04:00] for members. Good news for brokers out in the market. For sure. Yeah,

Michael Margherio:

Better experience,

And this is just some of the numbers that you see there because of our national scale, some of these numbers are comically large, but I think the one that makes the most sense there is that 10 and a half there at the top. All of the programs that we put in place, all of the pieces that we weave together, whether that’s the network management, whether it’s the out-of-network savings programs, all of those things, guiding people to disease management, guiding [00:04:30] people to prevention helps lower overall trend, right? Saves something like over 10% on a total book of business level.

Jason Powers:

Yeah, that’s great. That’s great. You want to have results oriented changes, not just changes for the sake of change. So

Michael Margherio:

Yeah, if we’re doing it, there’s a reason for it. Yeah,

Jason Powers:

I love it. So some new networks.

Michael Margherio:

Yeah, this is actually, I would say the main thing here is those bottom two are narrow [00:05:00] and we launched it a couple years ago, but there’s some optionality in our portfolio and the kinds of plans that you can pair with the broad network, the kinds of plans you compare with the narrow networks and by definition causes confusion because now we’ve got multiple options of things happening on the same benefits but with different networks. So I thought it’d be useful to show what that looks like and which options compare with which portfolio. The thing that I said earlier is critical here we do these market by market, so [00:05:30] what’s available in Kansas City might not be available in another market. So definitely worth looking at the local product portfolio and the local network names, but that top one choice plus, that’s our biggest national network. That’s what most people use when they buy from us, whether it’s fully insured or level funded or self-funded, our broadest, deepest discount network. But there are some good savings in our narrow networks that core essential network in Kansas City is over 12% savings. It’s narrow. [00:06:00] You got to know what you’re buying and it got to be a fit for your employees, but it can save a lot of money

Jason Powers:

And I think the thing for brokers to realize when you’re looking at a UnitedHealthcare proposal and you see choice plus choice core essential listed in particular, if you’re looking at a renewal on a level funded case where you’ve got claims data, you can go back into UnitedHealthcare’s claims reporting, you can see non-network utilization, you can see network utilization [00:06:30] and if you’re not seeing, I think the tip that I give brokers, if you’re not seeing out of network utilization and you do see on a group that they’re primarily going to these three hospitals and these providers, you have the ability to dive a little further into the renewal instead of just looking at alternative deductibles and out-of-pockets, look at the alternative network and see is there an opportunity to move that case onto a narrower network [00:07:00] not creating a disruption and just improve the price point for the employer and the employees.

Michael Margherio:

We’ve seen that strategy improving the price point and also we’ve seen other strategies keep the price point the same but make the benefits richer for your employees, which in this current economic situation where finding employees is very difficult, richer benefits are suddenly a draw more than

Jason Powers:

Ever. If you can go from a $4,000 deductible on the choice plus product to a thousand dollars deductible on [00:07:30] core and not sacrifice the providers that the people are really using, you certainly put yourself in a better position I think with the employees

Michael Margherio:

Gives people a new

Jason Powers:

Option. Yeah, love it. Let’s see. On Humana,

Michael Margherio:

Yeah, so with Humana leaving the commercial market, one of the things that our two organizations did was come together and figure out can we be a solution for their clients that are no longer going to have [00:08:00] Humana as a renewal option. And so what we’re starting to do with 11 one effective dates and I think 12 one quotes are starting to go out the door and one in a couple of weeks we’re going to proactively quote that, right? So where they’re not getting a Humana renewal, they will get a proactive UnitedHealthcare quote trying to save the brokers. That hassle of sending out the R F P and scrubbing all the data and flipping it over the fence, we’ve got that from Humana, that was part of our transition agreement with them and it allows us to get that quote [00:08:30] out the door and we’re sending it to the broker of record according to Humana that trying to be as straightforward as we can to make sure that nobody gets cut out of the deal. But so far the feedback has been that this is very helpful and I think it’s going to go a long way. You’ve got some good,

Jason Powers:

You guys are looking at the claims data and so if they qualify for level funded, that’s right, but they’re on an A plan with Humana giving them options, you’re giving them that level funded option.

Michael Margherio:

I’m pretty happy about this. It’s definitely generated a lot [00:09:00] of conversation and I think really ease of doing business with Humana leaving.

Jason Powers:

Yeah, I’ll tell you from our perspective, we serve as a general agent to producers out in the market and just having that information flow from UnitedHealthcare has really helped some of the agents that were not sure what was going to happen to their Humana business, being able to put the fears of the employer at ease that you [00:09:30] will have an option, it’ll come from UnitedHealthcare and we’ll be able to replace that Humana coverage product portfolio though might be a little different. There’s not an exact match to some of the unique things that Humana was doing from the product portfolio, but from what we’ve seen in that practical application of this endorsement is that United’s doing a really good job of trying to map as closely as we can. An option as closely as you can with alternative options throughout [00:10:00] that portfolio. Exactly. Yeah, that’s great. What else is new for level funding in 2024?

Michael Margherio:

As you probably know, level funding for our under 100 market has been our fastest growing product suite and we’ve done some things to try to enhance it. So one of the things we did a couple years ago was we built a narrow pharmacy network to try to drive some savings and it drove a lot of confusion I think, and maybe not as much savings. So I was glad to see us try it, but now I’m glad to see us pivot back. [00:10:30] So undoing in most places, undoing that narrow pharmacy network, it was anchored on either Walgreens or C V Ss. And now going back to including both of them with, there’s a couple of exceptions you see on there, renewal clients will have an option whether they keep what they have if it’s working for them or they can move back to the broader pharmacy network.

Jason Powers:

Got it. And there’s a naming convention on the product?

Michael Margherio:

There is, yes.

Jason Powers:

We’ve got it. So we’ll have all that information posted below.

Michael Margherio:

Yeah, [00:11:00] it’ll be clear on that quote on which one it

Jason Powers:

Is. So below this video on our site on the UnitedHealthcare page, you’ll have links to flyers and more information that spell that out for sure.

Michael Margherio:

And then this virtual visits, I like this post pandemic, some legislative changes allowing us to put $0 virtual visits into qualified high deductible health plans, which we couldn’t do before. So taking advantage of that. This is starting with new business January [00:11:30] of 24, putting that $0 virtual visit into the, I think what we all call H SS A plans. So I think that’s a very good post pandemic silver lining of some of the outcomes from that.

Jason Powers:

Eventually we’d like to see them just permanently authorize that so that it’s not something that comes up every year or two.

Michael Margherio:

It’d be nice. Yes.

Jason Powers:

Yeah, that’s great though. I think that’s probably one of the things that brokers run into and walking [00:12:00] in with an H S A proposal, especially if you’re doing a dual option right alongside a copay option and being able to say, Hey, but if you use virtual on this side, it’s free over here on the H S A, there was a cost associated, so it breaks down that barrier. It allows employees, particularly in that high deductible situation, you want them using telemedicine versus using providers for things that can be solved over

Michael Margherio:

Telehealth. I think both for cost and convenience reasons and increasingly [00:12:30] access to care reasons, which I think you see on the next page, behavioral health, which is a conversation that’s exploded. It was there in hiding before the pandemic and now it’s out in the open for everyone since the pandemic. But accessing providers for behavioral health can be very difficult. People don’t know how to find the right provider or what I call the front door into the system. And so this is a great, great tool for giving people access to a provider you need usually fairly [00:13:00] urgently, right? They tell you they’re not free for six weeks, that’s a problem. And a lot of those behavioral health situations. So having that as part of that healthiest you virtual visit is super valuable. I don’t want to minimize the other ones, right? The everyday primary doctor visits are useful. Dermatology is another one where the wait times are such that it’s almost kind of ridiculous, and so being able to do it through the virtual is very helpful.

Jason Powers:

Yeah, absolutely. And the healthiest you product [00:13:30] that can be applied, at least on the level funded side, applied to every member of the household, doesn’t matter if they’re on the plan or not. So you could have members that are, and this is unique to UnitedHealthcare’s product, it can’t stress that enough that the healthiest you telemedicine applies to everyone. It’s even if you’ve enrolled as single coverage, but you’ve got a member that is or a subscriber that has a spouse and kids at home that maybe don’t have coverage through healthcare, they still have access to that benefit for your charge, [00:14:00] which is super, it’s a huge, yeah, huge. Hugely helpful.

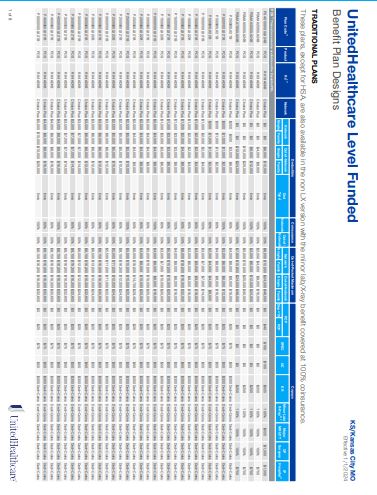

Michael Margherio:

The next suite of stuff is just some new plan designs that are coming out for January, and this slide builds slowly, sorry about that. There are three categories of these and really trying to bring some simplicity to it. So the zero deductible plans there that are marked max, so that’s that code that you’ll see on the product portfolio, really trying to bring some simplicity to it. No network [00:14:30] deductible. A hundred percent

Jason Powers:

For insurance. Simplicity, huh?

Michael Margherio:

Yeah, bringing, making it simple for people to navigate, which we’ve made this,

Jason Powers:

I’ll say it because I can say it. This is a good answer to the Humana portfolio that’s had a zero deductible plan that had everything going toward copay, so this is a great time. I think for United to roll that product out, especially with the Humana endorsement, helps with mapping some of those products over effective one. [00:15:00] One obviously in the 12, because this is for one one, right? This is for one, one, yes. So for the 11 one and 12 one United offers for Humana clients, you’re not going to see that max option. Not yet. But for January and beyond you will Correct.

Michael Margherio:

That’s great. And then there in the middle, some more copay only plans. Again, trying to give the employer some flexibility here but still overall simplify the benefits. And something that you see of course is when it’s a copay [00:15:30] only plan, they’re a little bit richer, so you got to make sure that the price point works for you. And so there’s some options there with the multiple networks that we talked about and P D L options as well for the pharmacy

Jason Powers:

Plans. Yeah, love

Michael Margherio:

That. And then the last column, again, this is an expansion of giving people more options inside H S A plans, we have an expanded preventive drug list, so giving people access to more drugs at the $0 preventive copay inside those H S A plans, just really trying to take advantage [00:16:00] of getting people lower access, no barrier to get their care.

Jason Powers:

Yeah, I think this will really help. Looking at 2024, I mean United did something similar in 23 with a lot of the product rollout last year. Having these as options inside that level funded space in that two to 99, it gives you just a lot more options to choose from. Things to talk about strategically with clients that [00:16:30] it opens up the conversation to be able to go in and have some different ideas, different approaches, rather than just raising deductibles, raising out of pockets,

Michael Margherio:

Agreed. And help target what is that employer strategy. We’ve seen a lot of people that want to buy richer benefits because of the economy because they’re trying to attract employees. So we’re trying to make that available to ’em.

Jason Powers:

Yeah, love it. Love it. All good stuff.

Michael Margherio:

Alright, mineral. This is one that is not new. We launched this maybe this time last year. I think [00:17:00] what is different now is, well, it’s not different. It’s the access. What we’ve seen people using is the document library they love. I think it’s up there. It’s a little bit hard to read. The HR compliance library they love and the compliance calendar. So really seems this makes sense to me, right? Smaller employers, first time in a level funded plan. There’s some compliance components that they didn’t have to do in a fully insured scenario and this has gone over really well with employers. That map [00:17:30] there, the blue states is where it’s rolled out, I think more scheduled to come online. So where your employer contract status is how that map reads. So it’s been very valuable. We’ve had a lot of people take advantage of it.

Jason Powers:

I mean nothing worse than having a group that gets into level funded and doesn’t realize they’ve got a PCORI filing that comes around every year. All those things

Michael Margherio:

Or an filing that comes every year, they would not ever have considered before. Exactly. Mineral does a good job for ’em

Jason Powers:

Too. And it’s a great library of information, interactive [00:18:00] tool. I know the agents that we’ve got with UnitedHealthcare cases that have had mineral installed. Again, good positive feedback from their clients and a welcome benefit, right?

Michael Margherio:

Yeah. Makes it easy to use.

Real Appeal is a new topic this year. Real Appeal is a weight management program. It’s based on the C D C diabetes prevention program. That’s the formal C D C program. There’s research [00:18:30] that goes back several years that shows if you lose five to 7% of your body weight and you add some, I think it’s 150 minutes of exercise a week, it cuts your risk of becoming a type two diabetic by 58%. So huge number where we’re showing that diet and exercise, managing lifestyle management prevents this disease, it’s preventable. But then the question is how do you get people to engage in that? And so what real appeal has done is [00:19:00] trying to take a little bit more enjoyable approach instead of saying, Hey, sign up for a diabetes disease management program. No one wants to sign up for that. Real appeal is focused on weight loss. It’s a little bit more, I’m going to say flashy, right? It’s kind of Hollywood produced. You get a virtual group, the programs are great, the instructors are amazing, the quality is good. You get things sent to you to help you with the success kit. There’s weight, food scales and personal scale and blender. If you stay [00:19:30] in the program,

Jason Powers:

Long portion control, portion

Michael Margherio:

Control, all the things that you need to help be successful in this program. The numbers speak for themselves. We have almost a million people in it and 88% of people lose weight. You got to do the work to keep it off. It’s not as easy as we get older, of

Jason Powers:

Course. I usually find all the weight that people are losing.

Michael Margherio:

It moves to you good. But I think one of the things that I always say is when you see us include it, so it’s been included in our fully insured, [00:20:00] we’re adding it to level funded new this year. When you see us include it in our portfolio, we believe it has a positive R o i.

Jason Powers:

You’ve got the

Michael Margherio:

Metrics, this program works, right? Yeah, that’s great. Exactly. Yeah, that’s great.

And then this is another one. This is not new. I think we talked about this last year. We moved to eliminating out-of-pocket costs for certain classes of medications and really kind of very specific. It’s a narrow list. I think there’s three or four of ’em on there. And it’s designed to [00:20:30] again, remove that barrier for people to care. The biggest difference this year is it’s now also in our level funded portfolio. We launched it in fully insured only, and a lot of traditionally self-funded clients also followed our lead, and now we’re doing it in level funded as well.

Jason Powers:

Yeah, it seems like a c a is sort of that experimental laboratory of features to help control costs. And then we see those things move over to level funded. That’s kind of in the,

Michael Margherio:

[00:21:00] I think

Jason Powers:

That’s right MO for the last

Michael Margherio:

Couple years, primarily because of the size of the block of business where we are going to try it out, where we think it’s going to have the most impact and we see success and then we move it into other

Jason Powers:

Parts. Yeah, no, I like it. So then those are the kind of drugs there that have no out-of-pocket costs. Correct. That’s

Michael Margherio:

Great. And they have to be on the preferred drug list, right? There’s plenty of drugs in those categories, but only the preferred ones. Yeah,

Jason Powers:

Makes sense. Yeah. This is another one that’s not new. We talked about it last year, but

Michael Margherio:

Right. Not new but a little bit enhanced and [00:21:30] now we’ve got some better data. So the enhancement is the card. So it used to be that you could use it for urgent care and virtual visits and certain outpatient behavioral health and only at Premier doctors, our U H C premium designation, narrow network, we’re adding lab visits to that. So maybe not a huge expansion, but another thing that in terms of removing a barrier, a cost barrier to access lab visits can be one of them. So [00:22:00] the structure’s all the same, right? $200 for an individual, $500 for family coverage and still can roll over up to $2,000. What we’ve seen when you see the next page, really some amazing savings, and I think we all in the industry know this, right? If you can convert somebody from a urgent care visit to a virtual visit, maybe that’s not for everybody. There’s the right reason to go to the emergency room. But if we’re going to the emergency room for the wrong reason, and you can convert that to virtual or at least start virtual, you can save [00:22:30] a lot of money. So helping employees make better decisions and aligns with higher quality providers and lower costs, which win for the employer, win for the employee as well. They get better care for lower

Jason Powers:

Costs. I mean, again, you have the metrics, right? Average savings of a thousand to 1500 bucks per is that

Michael Margherio:

Virtual visit. Yeah, virtual visit. If you convert from an

Jason Powers:

Emergency emergency room,

Michael Margherio:

Which I mean emergency rooms

Jason Powers:

Are expensive, [00:23:00] it’s a thousand dollars. I tell people it’s thousand

Michael Margherio:

Dollars. They’re for a reason, but they’re expensive,

Jason Powers:

Right? Thousand dollars to walk in the glass doors of just about any emergency room in the country. And to be able to use the benefits that United’s offering in conjunction with just educating people about where they can go

Michael Margherio:

To receive care. Well, it’s helpful to them helping them get to the right spot. So

Jason Powers:

That’s

Michael Margherio:

Great. It’s finding that front

Jason Powers:

Door. All good stuff. Yeah.

Michael Margherio:

The U H C rewards, this is new. It’s kind of a conglomeration [00:23:30] of a bunch of different stuff we’ve been doing over the years in the wellness space. So

Jason Powers:

Kind of replacing rally if you will.

Michael Margherio:

Yeah, rally and motion and some other programs that we’re all disparate are now all consolidated into U H C rewards. Much easier experience, much simpler and straightforward in terms of the member experience and how you access it. It’s all in the U H C app, which something like 83 people, 83% of people download when they join our plans anyway, so they’re already getting it. They’re looking at [00:24:00] their ID card and their claims and so forth. And now all of this is in there. The other thing that I really like about this is it’s expanded the way that you can earn the rewards and it’s more customizable. I might want to walk, you might want to, I dunno, go to the doctor’s office and get your preventive care visit.

Jason Powers:

I don’t want to run, think you didn’t say fair enough. Not that I might want to run. Nobody would believe you. Way

Michael Margherio:

More options and then easier to redeem the rewards and really just a much more consolidated feel instead of [00:24:30] a bunch of different what felt like add-on programs to people. I think.

Jason Powers:

Yeah. Mean would you then describe it, this is really meeting the member where they are versus

Michael Margherio:

I think so

Jason Powers:

Trying to make it out of reach

Michael Margherio:

Much simpler for them. I think people know by now that their employers are offering a wellness program. Some

Jason Powers:

Of ’em do,

Michael Margherio:

But trying to make it simple for ’em. So what you see here is all the options now of the ways that you can get those various rewards. [00:25:00] Right now what I’m showing you is the fully insured version, and there are two models. This is one of those areas where pay attention to geography. In Kansas, for example, we can only offer the core. You can’t buy up, but in a lot of states you can buy up to the premium. So depending on what your employer or client is looking for and how aggressive they want to be with changing that incentive, going from 300 to a thousand can be a big deal to the employees. So making sure that we get that right up front and

Jason Powers:

[00:25:30] Core here and premium here, these are not the same as the core network or premium designated. It’d

Michael Margherio:

Be lovely if we had more adjectives instead of recycling the same five words

Jason Powers:

Over. I think it’s important. I think you’re right. When an agent sees core rewards on a proposal, it’s not

Michael Margherio:

Core. I would call it base, the base program, the base plan and the buy-up plan, but we’re using corn and premium. That’s a good distinction to draw out. I agree. Yeah, for [00:26:00] sure. And then the other thing is there will be a level funded version of this that will be very similar. I think there will be some subtleties. So our team’s working through that to make sure that as we launch that it makes sense

Jason Powers:

To the market. Okay. And right, so right now this is fully insured a c a plans two plus.

Michael Margherio:

This is 51 plus. Yeah.

Jason Powers:

Oh, this is 51 plus.

Michael Margherio:

Oh, I’m sorry. No, this, this

Jason Powers:

Includes the ACA two. Yeah, embedded aca. Yeah, sorry. And the 51 plus. Yes. Fully insured. And then we’re rolling it out and level funded, but that’ll come down the road. Yep. Got it. Yep. That’s great.

Michael Margherio:

[00:26:30] And then

Jason Powers:

Got to talk ancillary. Yeah, got to talk ancillary. Ancillary is tomorrow, Mike. Ancillary

Michael Margherio:

Is tomorrow. But I am going to get a jump on your ancillary carriers for tomorrow. We have an entire suite of ancillary services and think one of the things that we talk about a lot is the bundling and the cost savings, and we’ll get to that. But I think more important is it allows us when we have the dental and the medical or the vision and the medical, we have a better picture of that person’s health and we can help engage them more effectively. [00:27:00] So getting that ancillary plan information into our system, when that person is talking to our advocate, we have a better picture of what their challenges are and what their opportunities are and we can manage them a little bit better. That’s why the bundling of the pricing works, because it makes more sense to manage those folks and so we can get them better outcomes at lower costs and therefore we can offer some of the bundling that comes with it. But this suite of portfolio is very broad. [00:27:30] We added to it pet insurance a couple of years ago, which I’m not an animal guy. Everybody

Jason Powers:

In my get more and more questions about pet insurance. Everybody

Michael Margherio:

In my office knows that I have no pets in my house, but pet insurance is an exceedingly popular benefit. It’s all sizes of employers are asking for it right now. We’re only at a hundred plus, but I think that’ll change in the future. And then global coverage has been a topic that we’ve talked about a lot. Expatriates, repatriation, services, all those things. And purely just travel benefits [00:28:00] for your employees. So we have all of that suite of products as well.

Jason Powers:

Yeah, I mean goes to that. It’s a global economy. There’s a lot of businesses that are based here in the United States, but do business overseas and employees that are traveling back and forth and

Michael Margherio:

The coverage for those can be very complex. So you want somebody who’s done it and has the right systems and basics in place.

Jason Powers:

Yeah. UnitedHealthcare doesn’t have a contract with providers over in Dubai or you might, there

Michael Margherio:

Are global [00:28:30] networks to be had. Yeah. Depending on the kind of coverage you’re looking

Jason Powers:

For. It’s amazing. It’s a matter of just putting the right product together.

Michael Margherio:

Alright, so the next three pages are size iterations of our various bundling programs. This is another one where we bring a lot to the table and I think we confuse people. So the first page here is this is a limited time offer. This activate the savings is just through the end of the year. I think it’s ten one through one effective dates. And so you can see that it’s a $50 [00:29:00] per sub on dental. It requires a certain level of you’re adding the coverage to it or selling the coverage together. And it’s a 10 plus subs that have to enroll to get there. But savings for adding that dental and all of these bundling programs, there’s some minimums. There’s some have to hit certain enrollment percentages.

Jason Powers:

So this is effective one on the fully insured and the level funded space.

Michael Margherio:

This is through one. One I think we started

Jason Powers:

Oh, it’s through one. I’m

Michael Margherio:

Sorry. [00:29:30] It ends with one effective dates.

Jason Powers:

Yeah. Helps if I read.

Michael Margherio:

Yeah. Well, and we put it in pretty small font

Jason Powers:

For you, Jason. Okay. So it’s going to go through January one effective dates. So this then sort of replaces that 2%, 1%, $1, $2 credit. This is a 50 per sub based on the dental subscriber count, but it does require they’ve got the medical bundling and Got

Michael Margherio:

It. And again, this one’s just for two to 50. The next page shows all of the bundling for [00:30:00] two to 99, and you can layer these on top of each other. This is where it gets confusing. Of course. This is what I’m going to call our normal bundle package

Jason Powers:

Approach,

Michael Margherio:

Right? There you go. The $3, $2, $1. Again, this is both fully insured and level funded. This is, I’m going to say this is the standard. This is what we’ve had in the market for a while now. The plans have to be contributory and you do have to hit certain levels of eligible employees enrolling in them, but [00:30:30] like your State Farm, right? We’re going to put ’em all together and bundle my home auto and this is the same thing. There’s value in these and it helps drive some better outcomes for the employees as well.

Jason Powers:

Yeah, for sure.

Michael Margherio:

And then the last one is the 51 plus version. So again, iterating through the size frames, but for 51 plus, again fully insured or level funded, we’re doing it on percentage. That 2% for dental gets a lot of people’s eyes open. It can [00:31:00] drive a ton of savings.

Jason Powers:

Yeah. That’s 2% off the medical premium, right

Michael Margherio:

Off the medical premium.

Jason Powers:

Exactly. That can make a lot of difference, especially if you’ve got a lot of dependents enrolled on the medical to add dental drop in 2% off the total premium. That’s a big chunk and

Michael Margherio:

That stays in place as long as those lines stay in place. Right? It’s not just a one year look, it’s a permanent two or up to 4% if you add all those lines. So it’s been very productive.

Jason Powers:

We found that to be a big benefit in [00:31:30] that space in particular, if they’ve not had dental in the past, rolling out dental, using the percent of the medical savings to offset the cost of the dental. Great way to add some other lines and improve the value of the overall package that employers offering.

Michael Margherio:

And I get that there are people out there that don’t think of us first for dental and vision, but I think our dental network is the second or third largest in the country. Our vision network is a unique structure. [00:32:00] It’s about a 50 50 blend between private practice and retail providers. So unique as compared to some of the other vision networks out there and really helps fit the employer’s population pretty well. So

Jason Powers:

Products would successful. I’d argue that our persistency with the agents we work with that do package dental and vision or just dental with medical with UnitedHealthcare, the persistency there is probably higher than some of the ancillary carriers where they don’t have medical and they just have ancillary. [00:32:30] I bet persistency and stickiness is a lot higher.

Michael Margherio:

Those I think that’s right. Our studies show the same thing. And then also it’s simpler for the employer. You get everything through one portal,

Jason Powers:

Could be one bill thing. Bob saying thing one service is a lot easier on his side. Easier to manage it for the employer and the agent. Yeah. Well that’s a lot to take in. Yeah, a lot of stuff. Always a lot of stuff us. Lot to in Mike as always, really enjoy you coming on and updating brokers out in the market about what’s going on with UnitedHealthcare. [00:33:00] If we can help you with your UnitedHealthcare quotes, be sure to reach out to our team here at Legacy Brokers. While we don’t have a general agent agreement with UnitedHealthcare, we do have some ways to work around those things to make sure that you’re earning your maximum potential. With UnitedHealthcare below this video on our website. If you’re watching this after the recording below this video, you will see links to marketing flyers and downloadable content that’ll help you get more confident in the product that you’re selling with UnitedHealthcare and the programs that Mike just covered. [00:33:30] Below that is a contact us link where you can reach out to our quoting team, we can help you with your next case. Thanks again, Mike. Thanks for having me. Appreciate it. Yeah, and thank you brokers for tuning in. Happy selling. We’ll see you next time.

Thank you for watching this edition of our carrier product update series. Visit our website to watch other episodes.

Frequently Asked Questions

Who is Legacy Brokers?

We are a General Agency that focuses on group health and ancillary insurance products. We are the experts in small group self-funded and fully-insured products. Our clients are licensed insurance agents, just like you. It doesn’t matter if you focus on P&C, Financial Services, Medicare, Life and Annuities. If you have a health insurance license then we can help you win more business.

What services does Legacy Brokers provide?

- We run your quotes

- We help you analyze the quotes

- We assist you with the sale

- We help you service the case

- We help you renew the case

Does using Legacy Brokers cost me anything?

We have a GA contract with many of the carriers that we quote. For those carriers, we earn an override and you earn 100% of the producer commissions, so it will cost you nothing! With that said, other carriers may be a little different and the commission structure could vary from case-to-case. Whatever the circumstance might be, our number #1 goal is to help you maximize your profits for each case every year!

How do I get started?

That’s the easy part! We can start the process in a number of different ways.

- Click on the blue “Speak to an expert” button at the top or bottom of this page, fill out the required information and an expert will get back with you in less than 24 hours.

- Call or email us directly: 1-800-844-1901 or 913-631-0102 / [email protected]

Who owns the Client?

You Do! Whether we operate side-by-side or one step behind you, we never jump in front of you because it’s YOUR client. It’s our job to continuously earn your trust and service your business throughout the year. If you ever wish to move your business, you are free to do so with your clients in tact at any time – with no strings attached. Our goal is to be YOUR trusted advisor along the way.